Property Newsletter March 2025

Welcome to our monthly newsletter for property landlords. We hope you find this informative and please contact us to discuss any matters further.

Major new plans to modernise home buying

On 9 February 2025, the government announced reforms to the home buying/selling process, which will reduce the time it takes to buy or sell a home and help to stop property transactions from falling through.

The government intends to digitalise processes so that trusted professionals within the transaction chains can share key property information. Digital identity services will also help to cut transaction times.

The Ministry of Housing, Communities and Local Government is working with the Land Registry and those in the housing sector on a 12-week project to identify the design and implementation of agreed rules on data for the sector, so that it can easily be shared between conveyancers, lenders and other parties involved in a transaction.

The Land Registry will also build on its work in digitising property information and lead 10-month pilots with a number of councils to identify the best approach to opening up more of their data and making it digital, whilst the government moves ahead with plans for digital identity verification services.

The government also announced ‘Right to Manage’ secondary legislation, which was introduced to Parliament in February.

The new rules, which will come into force on 3 March, will empower more leaseholders to take control of their buildings more easily, giving them power over how their service charges are spent, and removing the requirement for leaseholders to cover the legal fees of their freeholder when making a Right to Manage claim.

Sonder Europe: An Update

In our February newsletter we covered the Sonder Europe Ltd case, in which the Upper Tribunal found that Sonder Europe Ltd’s supplies of stays in serviced apartments were not eligible for the Tour Operators Margin Scheme (TOMS) for VAT. The ruling means that the VAT payable to HMRC in respect of those supplies cannot be calculated on their margin and must be calculated under the normal rules (output tax payable less input tax reclaimable).

This may not be the end of the story, however. It is thought that Sonder will apply for permission to appeal the Upper Tribunal’s decision. If permission is granted, the Court of Appeal may decide in Sonder’s favour.

Scotland: Edinburgh tourist tax

Following consultation, Edinburgh Council has decided to use its powers under The Visitor Levy (Scotland) Act to introduce an Edinburgh visitor levy. The levy is being referred to as ‘tourist tax’ and will apply from 26 July 2026, although only for pre-bookings made on or after 1 October 2025.

The levy will be calculated as 5% of the paid overnight accommodation before VAT and will only apply for the first five consecutive nights’ stay. The levy will not apply to extras such as meals, parking, drinks or transport.

Anyone staying overnight in the following types of accommodation will need to pay the levy:

• Hotels, hostels and B&Bs;

• Self-catering accommodation;

• Caravan and camping sites;

• Student accommodation (when rented as visitor accommodation); and

• Vehicles and boats that are mainly in one place.

In Edinburgh, 2% of the levy will be reimbursed to accommodation providers, which is intended to cover the costs they incur in collecting the levy.

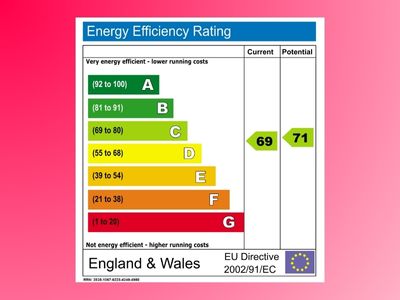

England & Wales: New EPC ratings proposals

The government is consulting on changes that will require private landlords in England and Wales to meet higher energy performance ratings by 2030.

Currently, 48% of all private rented homes have an Energy Performance Certificate (EPC) of C or above. However, under new plans the government is proposing that by 2030, all privately let properties will need to meet a minimum EPC C. Currently the minimum level required is EPC E.

The government estimates the average cost to landlords to comply with the proposals by 2030 would be between £6,100 and £6,800.

The consultation is looking for views from landlords and tenants on the proposals, including:

• Whether landlords should be required to meet a fabric standard through installing measures such as loft insulation, cavity wall insulation or double glazing, before moving onto other options including batteries, solar panels and smart meters.

• A maximum cap of £15,000 per property for landlords, with support schemes such as the Boiler Upgrade Scheme and Warm Homes: Local Grant.

• An affordability exemption that lowers the cost cap to £10,000.

• All landlords being required to meet the new standard by 2030 at the latest.

The consultation closes on 2 May 2025. If you are a landlord and wish to take part, the details can be found here.

MTD and jointly-held property

The first group of unincorporated traders and landlords will be mandated to comply with MTD for Income Tax requirements from 6 April 2026. In January, HMRC published a number of record-keeping and reporting easements for those with jointly-held property income.

For more information, see here and here.